Some decisions are difficult. What to do with the expiring Bush Tax Cuts is not one of them.

Immediately after the election the U.S. Congress will meet in its ‘lame duck’ session. Between November 7th and December 31st it will have some thorny issues to sort out. From implementing ‘sequestration’ cuts to dealing with the expiration of both long-term unemployment benefits & a 2% payroll tax reduction, this Congress will make decisions that affect Americans for generations.

While many of the policies are complicated, many of the decisions are simple. We should let the Bush Tax Cuts expire for the top 2%.

Our federal government, its budget, and its representatives should serve the people. Tax cuts for the top 2% serve the few at the expense of everyone else. The cost of extending the Bush Tax Cuts for households making over $250,000 is almost $1 trillion. That’s one trillion dollars that will not pay for health care, retirement, schools, roads, or anything else we all need.

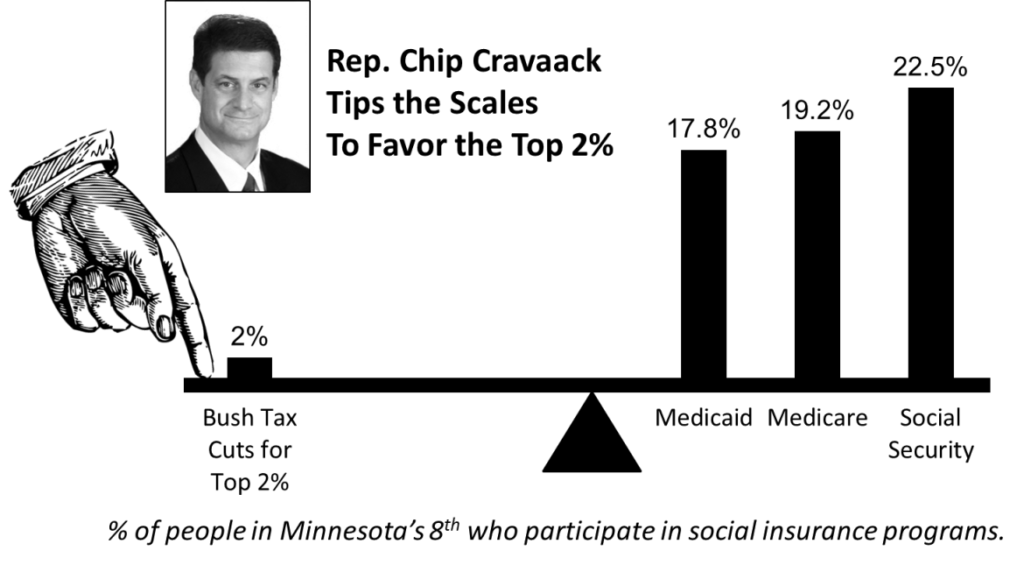

Look at the numbers for people living in Minnesota’s 8th Congressional District.

- Less than 2% of those in Minnesota’s 8th are in the top 2% (i.e. make over $250,000 per year.)

- 17.8% are enrolled in Medicaid.

- 19.2% use Medicare.

- 22.5% receive Social Security benefits.

In spite of this, Rep. Cravaack voted in favor of extending the Bush Tax Cuts for the top 2% as well as voucher-izing Medicare and block-granting Medicaid, changes that would force more seniors to use Social Security payments to cover health care costs.

As Members of Congress wheel & deal to create a ‘grand bargain’ we need leaders who will make sure we don’t get dealt out. Minnesotans count on Medicaid, Medicare, and Social Security in order to have a secure retirement. Can we count on Rep. Chip Cravaack to look out for us?

Chris Conry

Chris is TakeAction Minnesota’s Economy Program Manager.