Last Tuesday our political system moved one step closer to representing America’s emerging majority.

Our political system improves when our electorate more closely matches our population. In other words, when growing populations like young people, people of color, women, and progressives vote, we get a government more responsive to our needs. This is what happened in 2008 and 2012. It is what did not happen in 2010.

The challenge for political leaders going forward is to make sure this emerging majority has a reason to vote in 2014, 2016, and beyond. This is more than a messaging problem. It is a governing problem. Elected officials that fail to respond to the needs of these growing populations will likely find themselves subject to the see-saw ‘wave’ elections the country has been experiencing since 2002.

Like our political system, our tax system is most effective when it responds to our lived experience. Unfortunately, our tax system is currently out of sync with the economy we live every day.One of the key messages voters sent at the ballot box last week was that they firmly support making our tax system more fair. In a nationwide AFL-CIO exit poll, 62% of voters said their message to the next president and Congress was: “We should make sure the wealthy start paying their fair share of taxes.”

Our economy is changing. It is less equal and more service-sector oriented than it was 40 years ago. A steadily growing percentage of our workforce works in service industries. In particular, we have seen financial services nearly quadruple as a share our national economy. Still our tax code is built to respond to an industrial economy with growing middle class, two increasingly shaky premises for a sustainable tax system.

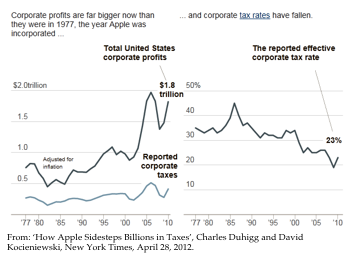

The lion’s share of the economic gains of the last 30 years has gone to our nation’s wealthiest 5%. At the same time their effective tax rates have fallen. Likewise, many U.S. corporations, while experiencing unparalleled success, have paid lower and lower effective tax rates. Our chronic state and federal fiscal crises are hardly surprising when you realize that our national economic gains have gone to the people and the firms that pay the lowest rates of taxes.

Over the next seven weeks the U.S. Congress will debate the extension of the Bush Tax Cuts. TakeAction Minnesota is involved in that debate because its outcome will have consequences for the basic investments that make all our lives possible: Social Security, Medicare, and Medicaid. Still, this is about more than a set of programs. What’s at stake is our basic social contract.

As we renegotiate it for our generation and the next, we should listen to what voters told us last week: we need an economy (and a tax code) that is of, by, and for us