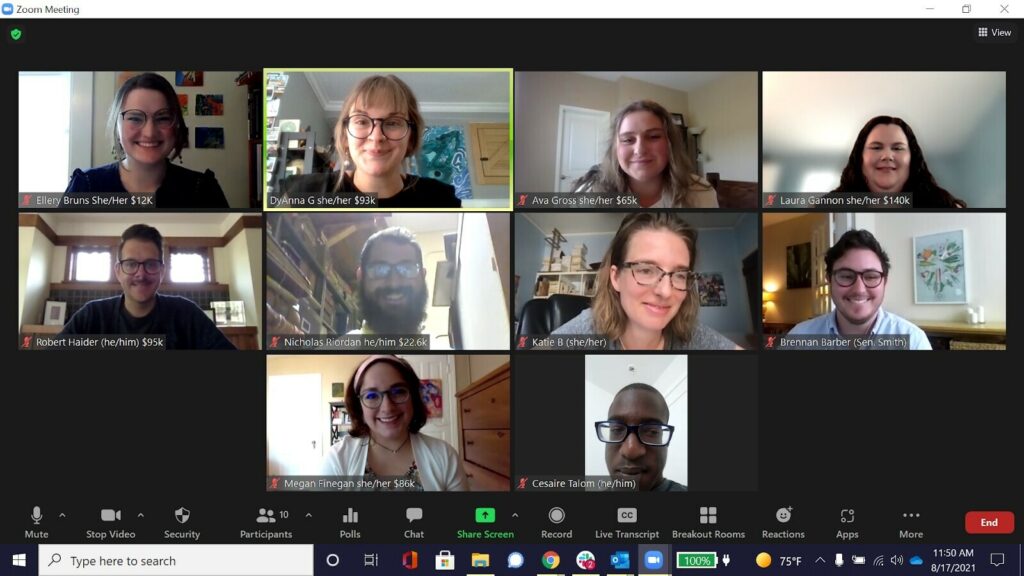

Hey there, it’s me, DyAnna! I’m one of the organizers behind TakeAction’s Student Debt Cancellation Crew.

The holidays are here. As the end of deferment looms, I want to share

Reflections: Sharing my education debt story with family

Reflections: Sharing my education debt story with family

As an organizer with the Student Debt Cancellation Crew, I constantly encourage fellow debtors to share the story of how education debt impacts their life. Our stories are our most powerful tools to move people to understanding and action.

As I anticipate sitting around the dinner table with my family this holiday season, I’ve been reflecting on how one of the people I love most in the world — my dad — doesn’t know my student debt story. He just knows the numbers: the initial loans, the first refinance, and the tax write-off. And, with the end of deferment looming, I know education debt is going to be a hot topic on the news. I’m realizing that, before he hears talking heads debating the merits of canceling education debt, I want him to understand why this issue matters so deeply to me. I want to invite him to be an ally in this fight.

Here’s what I’d tell my dad.

I am one of the nearly 45 million people with education debt in the United States.

I just signed the contract on my freshly-refinanced private education loans in preparation for payments resuming in February. All-in-all, even with my newly-negotiated 15-year payment plan on my private loans, I’m looking at $828 of my monthly income going directly to education loans — that’s more than my rent.

I’ve checked all the boxes and jumped through all the hoops since I graduated from college. This was my second time refinancing, and the counselor who I worked with to get it done ended our last conversation with a “looking forward to talking again next year when we can look at it all over again and see if we can get you an even better rate.”

Sometimes, my loans keep me up at night or fill me with dread and shame. I worry about being a financial burden on my partner, and I’ve fully accepted that I will never be able to afford to have kids (I wasn’t planning to anyway, but I’d like to have the option).

In a way, I am afraid to share this story with my dad. But still, giving a full picture of how this debt has impacted me might open up a conversation about student debt cancellation, and I want to know where my dad stands.

Why am I telling you this? Because I want you to know that, if you can relate to my story — and you’ve been thinking about telling your loved ones how education debt has impacted you — you’re not alone. Whatever comes out of my conversation with my dad, I know I can lean on the Student Debt Cancellation Crew for support — and you can too.

An invitation: Give yourself some grace

An invitation: Give yourself some grace

As a person who carries $93,000 in student debt (private and federal), I often feel a lot of shame and frustration with my younger self: I was brighter than this, how did I let this happen? I know that, for many, the resumption of monthly payments could reignite similar feelings. But I want you to remember: the system of education lending did exactly what it was designed to do: exploit for profit. It’s not your fault.

In the nine months since our campaign to #CancelStudentDebt began, I’ve learned a TON about education debt and the movement to cancel it. The resources I share below have been an important part of my learning journey and coming to terms with my feelings of shame and frustration. I also hope they’ll help you feel supported going into conversations with your family members — should you choose to have them — this holiday season.

While our personal stories are the most important things we can share to move people, it can be nice to have some prolific thinkers behind you, too.

I could go on and on about all my favorite resources about debt cancellation, so if you’re looking for more, send me an email.

Resources: Education debt essential reading

Resources: Education debt essential reading

- This opinion by Astra Taylor (Co-Founder of the Debt Collective), who I reference a few times in this list, is a powerful prescription for what President Biden can (and should) do to really “Build Back Better” — from fulfilling his campaign promise of cancelling education debt, to tackling medical and rent debt, too.

- Thomas Gokey, another Co-Founder of The Debt Collective and dear friend and accomplice of our team, wrote a piece earlier this year detailing exactly why There’s No Time Like the Present to Cancel Student Debt.

- Student loans were founded out of white supremacy and patriarchy, creating a crisis that — while it hurts everyone — impacts women and women of color disproportionately. Read more in Ms.

- Read this piece — Debt Demands a Body — by our dear friend Kristin Collier, a teacher, writer, and organizer. It’s both a haunting and illuminating essay that beautifully threads personal storytelling and historical + political education.

- I’m a big-vision person, and I feel like the orientation of this piece is helpful both because it lays out some real 1, 2, 3’s of what the folks in power could do, AND offers a sincere vision of what Biden could have/could be saying: What a better Biden would say about student loan debt.

No reading necessary: honorable mention

- This video just dropped last week. Take in stunning visuals and a 7-minute synopsis of the debt crisis.

- I’m a big podcast fan, and this episode of The Argument (feat. Astra Taylor) is a shining example of how the argument for student debt cancellation is an argument for the people:

- Our Crew practically eats, sleeps, and breathes by this episode of the BadFaith Podcast.

- The title says it all. Listen to this episode of the Ezra Klein Show: The Life-Altering Differences Between White and Black Debt.

I should say, too, if you’re looking for specific book recommendations, definitely dig into Debt: The First 5,000 Years, by anthropologist David Graeber and Can’t Pay Won’t Pay: The Case for Economic Disobedience and Debt Abolition by the Debt Collective.

Happy reading/listening/watching!

P.S. The Student Debt Cancellation Crew is preparing for a political education series on Student Debt Cancellation in the new year. Interested in joining us? Send me an email.

Take care + take action

DyAnna